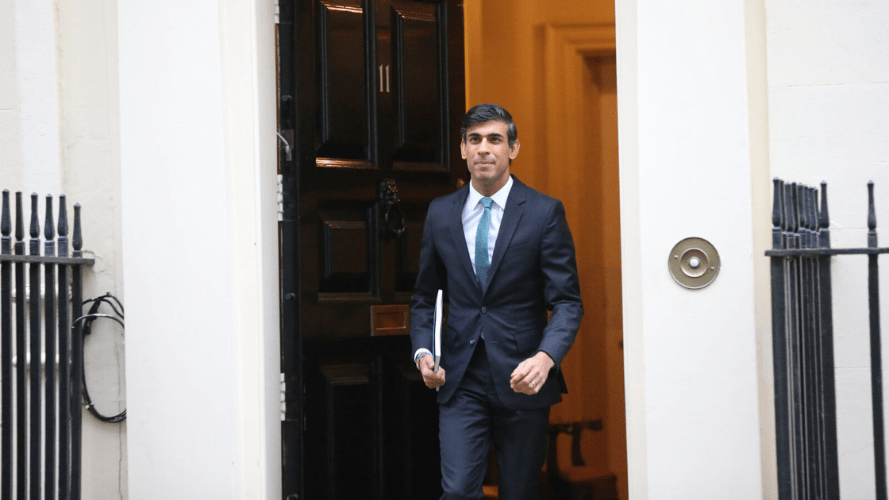

While the latest Budget from Chancellor Rishi Sunak made no direct mention of lettings or the private rented sector (PRS), it still included several property announcements that directly or indirectly impact the industry.

From a property perspective, the main pledges surrounded cladding and further investment in affordable housing. At the same time, agents will also be interested in short-term and long-term changes to business rates.

Here, we explore what was announced and some of the early reactions from the industry.

What was announced?

Sunak revealed a £5 billion fund to remove unsafe cladding from the highest risk residential buildings, which will be funded via a Residential Property Developers Tax imposed on developers with profits of more than £25 million at a rate of 4%. In total, 31 house builders made that much profit in 2019.

In addition, as part of the Government’s much-discussed levelling up agenda, there will be up to 180,000 affordable homes built on brownfield sites as part of a ‘multi-year housing settlement’ of nearly £24 billion, the most significant cash boost in a decade, according to the Chancellor.

Some £11.5 billion of this will be set aside to construct affordable homes, with the focus zoned in on developing brownfield sites rather than threatening the much-cherished Green Belt.

“We are investing more in housing and homeownership with a multi-year settlement totalling nearly £24 billion,” Sunak told a packed-out Commons. “The Government will provide £11.5 billion to build up to the 180,000 new, affordable homes the country needs annually, 20% larger than the previous programme. We are investing an extra £1.8 billion, enough to bring 1,500 hectares of brownfield land into use, meet our commitment to invest £10 billion in new housing and unlock a million new homes.”

The Chancellor also announced the reform of business rates to create more robust high streets with revaluations every three years from 2023, while investment relief will be offered to encourage businesses to adopt energy-efficient measures. Meanwhile, a new 50% business rates discount for companies in the retail, hospitality, and leisure sectors, up to a maximum of £11,000, will be introduced, lasting for one year.

In the small print released after the Budget, there was one minor change to Capital Gains Tax, with the deadline for filing a tax return being extended from 30 days to 60 days, from midnight tonight.

But the expected more major tax changes didn’t appear as property taxes, and further modifications to lettings were left off the table. The high-profile issues concerning stamp duty and inheritance tax weren’t mentioned once in the Budget, while there was very little on CGT. After years of big tax announcements and changes, this might come as a relief to the lettings sector, but others may be frustrated at the lack of certainty this latest Budget brings.

What did the industry say?

Timothy Douglas, Policy and Campaigns Manager at trade body Propertymark, said the Chancellor’s spending review provided some good news but left a lot to be desired.

“Raising the national living wage is good in principle, but with inflation expected to top 4% by the end of the year, higher household bills from the ongoing energy crisis, and the cut to Universal Credit, it’s unlikely to provide the boost to incomes that are needed,” he said.

“The £65 million funding for those in rental debt provides some support, but the devil is in the detail. Almost four million low-income households are in arrears with their household bills. Yet, this money will be targeted at those most at risk of homelessness, excluding others from help.”

He added: “£11.5bn for 180,000 affordable homes is welcome, but it isn’t new money, and only 32,000 of those homes will be social rented housing – a mere third of what’s needed, which isn’t enough when council waiting lists are predicted to almost double by next year.

“The UK Government has also missed a golden opportunity to reshape an outdated Stamp Duty Land Tax system to reflect rising house prices and remove some of the market distortions it causes.”

He continued: “It’s further disappointing there’s no reform of the court system to deal with the volume of possession hearings or proper funding for landlords, so calls for energy-efficiency improvements on an older private-rented stock are financially viable.”

Others in the industry have stated their disappointment that the PRS didn’t receive enough attention, with some suggesting that it isn’t a priority to the Chancellor and others concerned that it shows that he’s happy with the state of the PRS.

What else was announced?

Sunak said a taper reduction on Universal Credit would offset the recently implemented £20 a week cut. At the same time, the scheduled fuel duty increase was cancelled for a 12th successive year.

Inflation, currently at 3.1%, is anticipated to increase to 4% over the next year, while Sunak admitted that supply chain pressures will take months to ease as these are ‘shared global problems’.

The Office for Budget Responsibility (OBR) also revised its growth forecast upwards, with the economy expected to grow by 6% in 2021. The OBR says unemployment will peak at around 5.2% cent, lower than previously expected.

Sunak also set out two new fiscal rules for the Government, that underlying public sector net debt should be falling as a percentage of GDP; and that, in normal times, the state should only borrow to invest. That means everyday spending must be paid through taxation, Sunak said.